INNOVA Solutions.

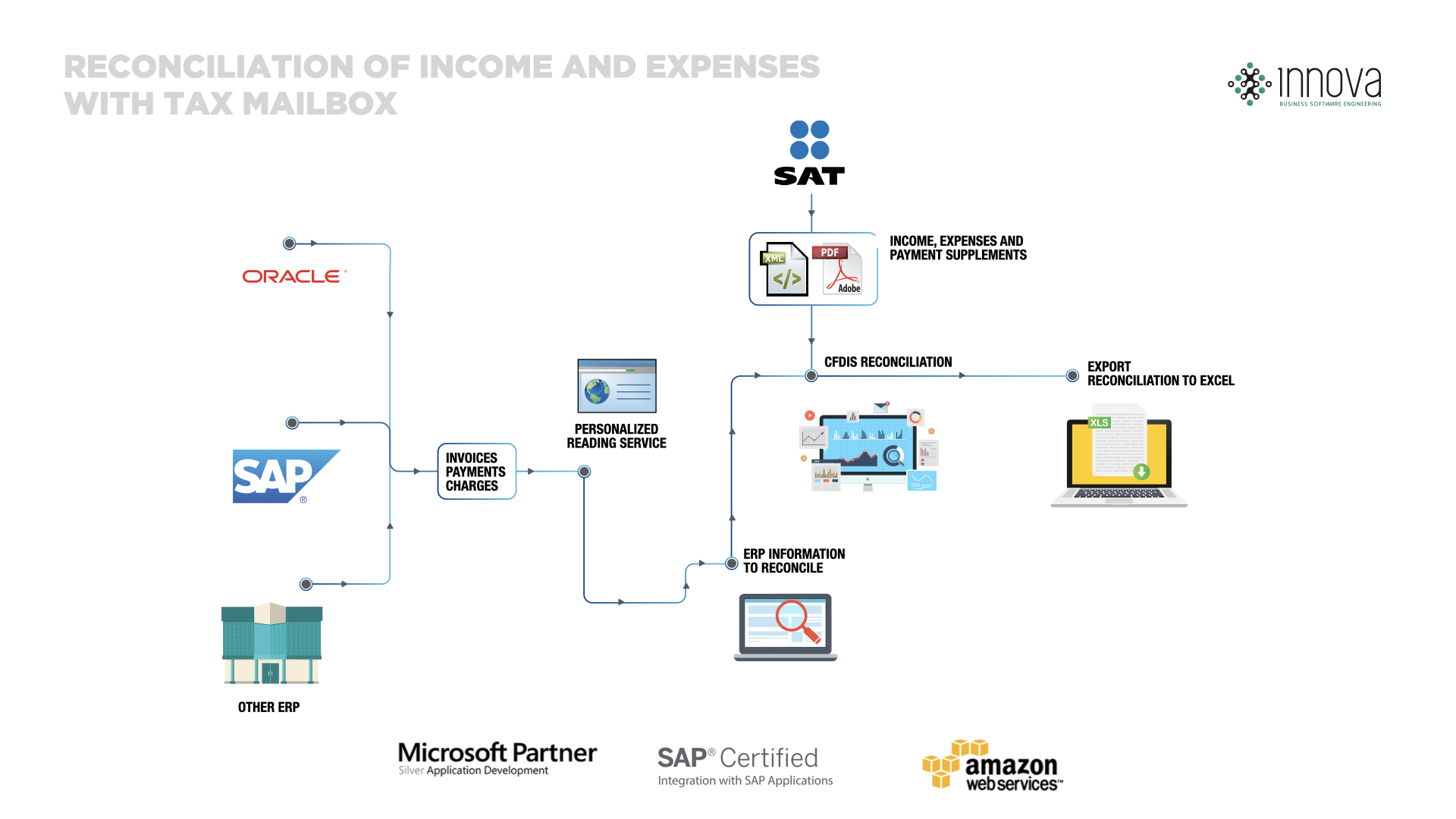

RECONCILIATION OF INCOME AND EXPENSES WITH TAX MAILBOX.

Solution compatible with Oracle and SAP for validation of CFDI’s issued and received with the tax mailbox, download of missing CFDIs in the ERP and reconciliation of amounts.

- Automates the reconciliation of CFDI’s with the SAT tax mailbox, allowing it to be done periodically

- Option to import CFDIs and Payment Complements from tax mailbox

- SAT Blacklist Validation (69 and 69b)

- Updates according to changes in tax provisions

- Collection of payment complements with option to notify the supplier of pending complement payments

- Allows reconciliation of several periods simultaneously

- It allows exporting to Excel the information downloaded from SAT as well as the reconciliation

- Personalized reading service from reports generated in the ERP

- Download up to 200,000 receipts per request

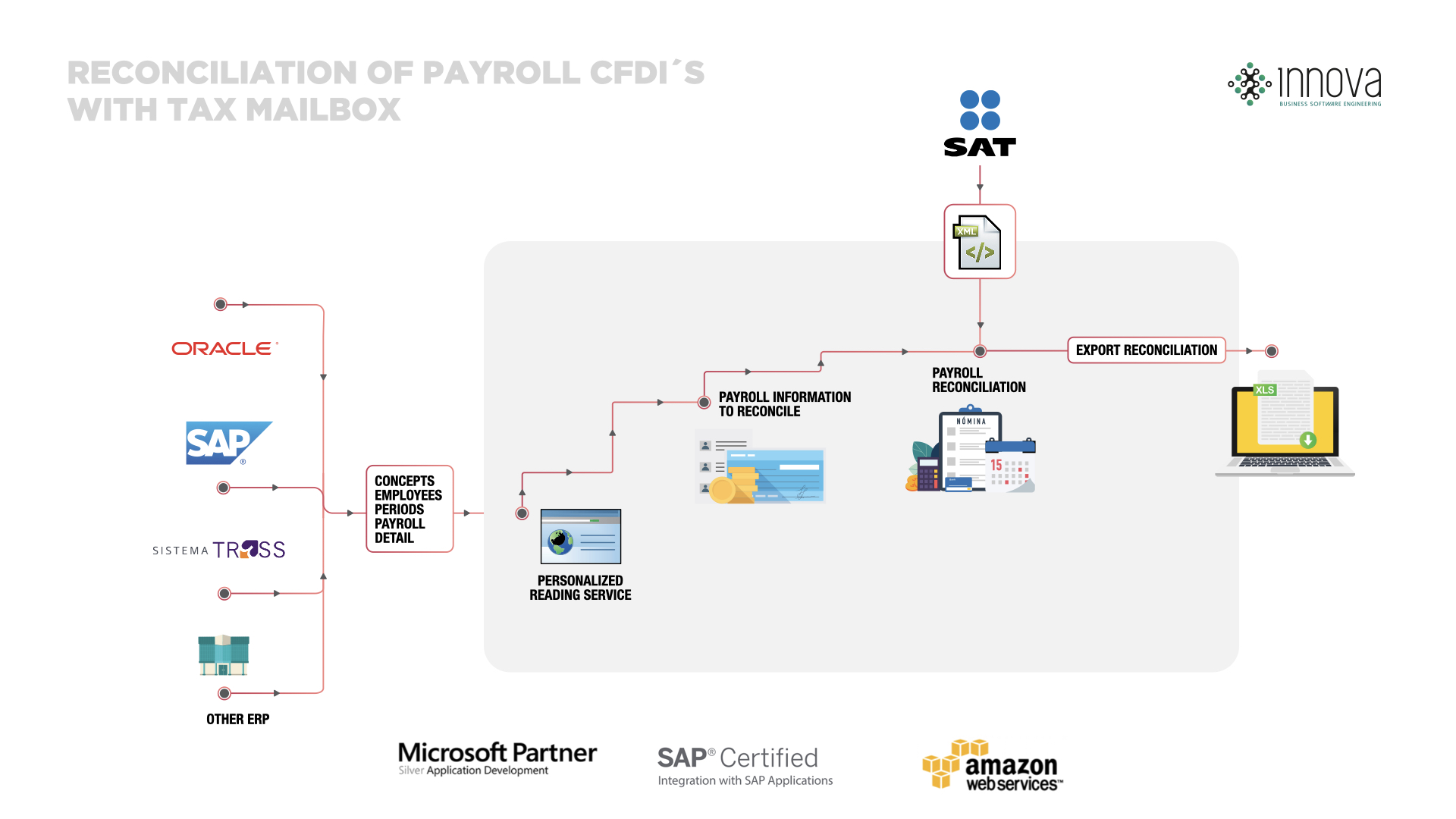

RECONCILIATION OF PAYROLL CFDI´S WITH TAX MAILBOX.

Solution compatible with any payroll system for validation of CFDI’s issued and received with the tax mailbox. Performs the reconciliation of amounts at the level of concept calculation.

- Automates the reconciliation of CFDI’s with the SAT tax mailbox, allowing it to be done periodically

- Reconciliation at the payroll concept level

- Allows reconciliation of several periods simultaneously

- Reduction of man hours in the validation of CFDI’s

- It allows exporting to Excel the information downloaded from the SAT as well as the reconciliation

- Personalized reading service from reports generated in the payroll system

- Download up to 200,000 receipts per request

- Allows simultaneous download requests

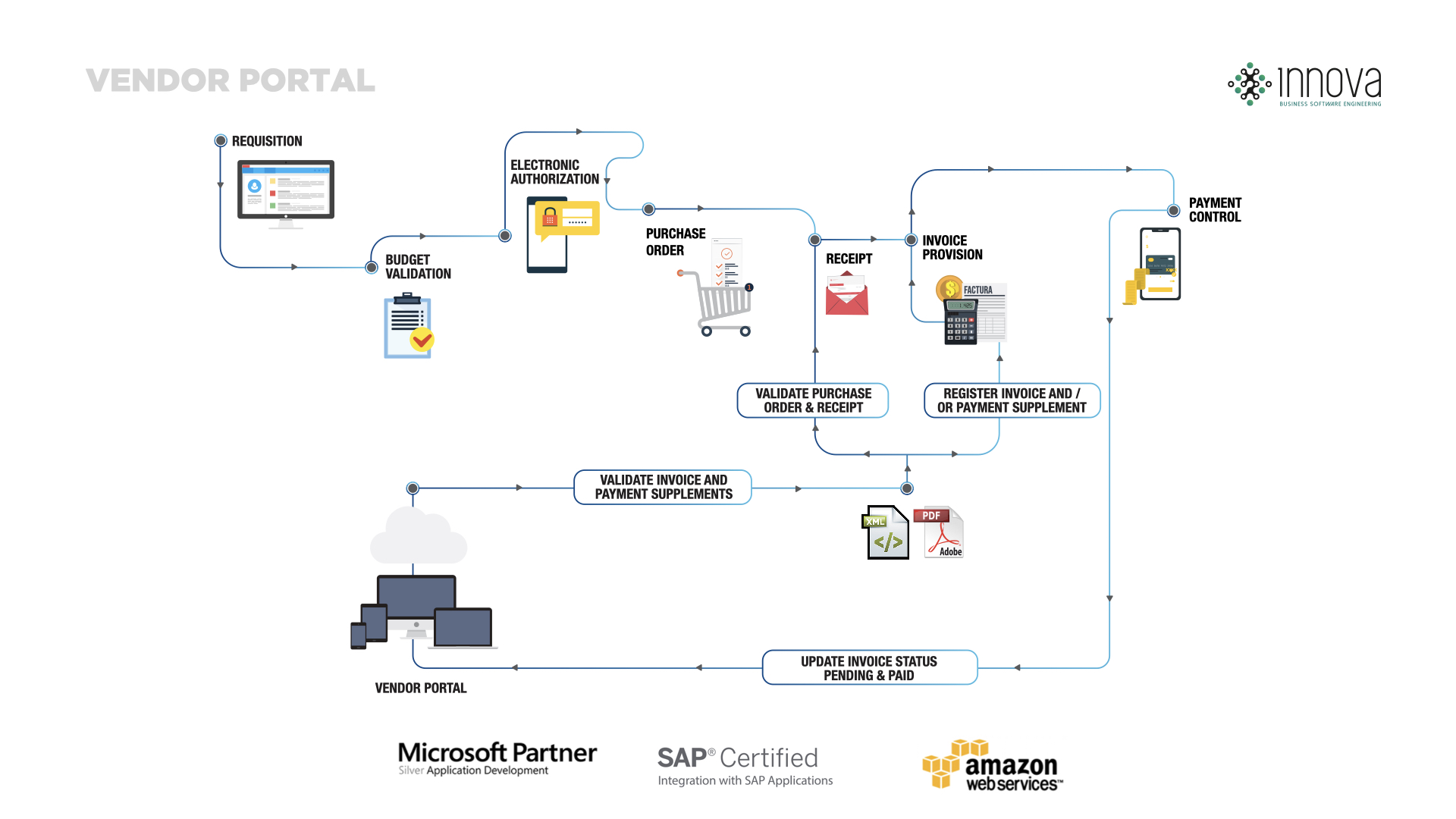

VENDOR PORTAL.

Website portal that allows you to collect invoices from your suppliers online while applying tax and administrative validations to them.

- Validation of the CFDI format and mandatory information by SAT

- SAT Blacklist validation (69 and 69b)

- Upload and validation of positive compliance opinion

- Update according to changes in tax provisions

- Registration of the UUID in liability and discharge vouchers

- Collection of payment complements and notification to suppliers of pending complement payments

- Validation of purchase order and receipt

- Online feedback to the supplier when importing the invoice

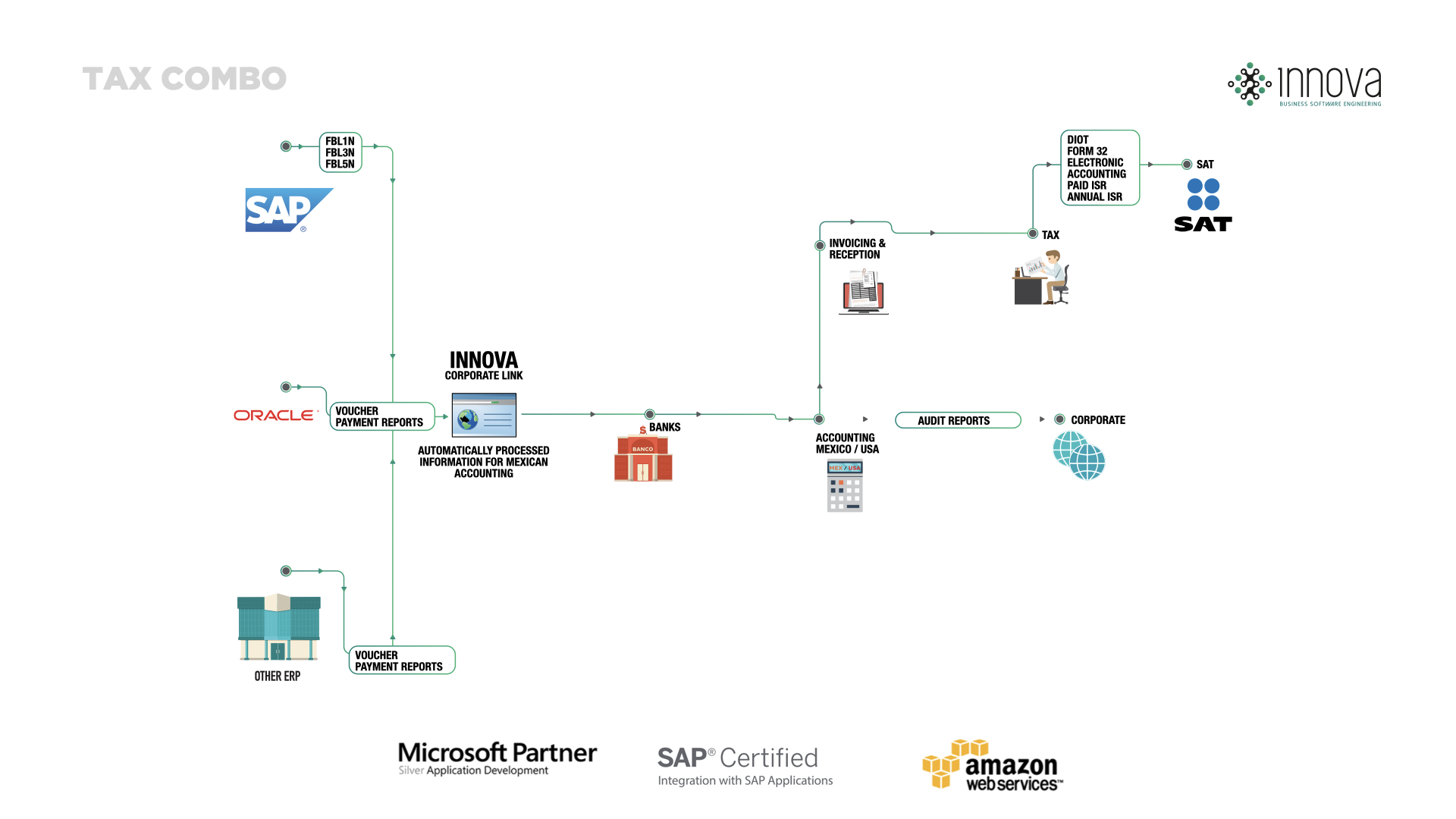

TAX COMBO.

Oracle and SAP-compatible solution to complement tax requirements. Eliminates manual labor to obtain Mexican accounting and compliance with tax obligations. It reduces audit risks and facilitates the detailed control of updated information according to changes in current tax reform.

- Generation of XML files to transmit Accounts Catalog, Balance and Vouchers to the SAT tax mailbox

- Determination of IVA actually collected and paid and file generation of file for DIOT (Form 29)

- Validation and storage of CFDIs

- Handling of Payment Complements and relationship with the original invoice

- Provisional ISR payments

- Tax depreciation of Fixed Assets

- Annual ISR Income Tax Declaration

- Annual adjustment certificate for inflation and other work papers for the annual declaration

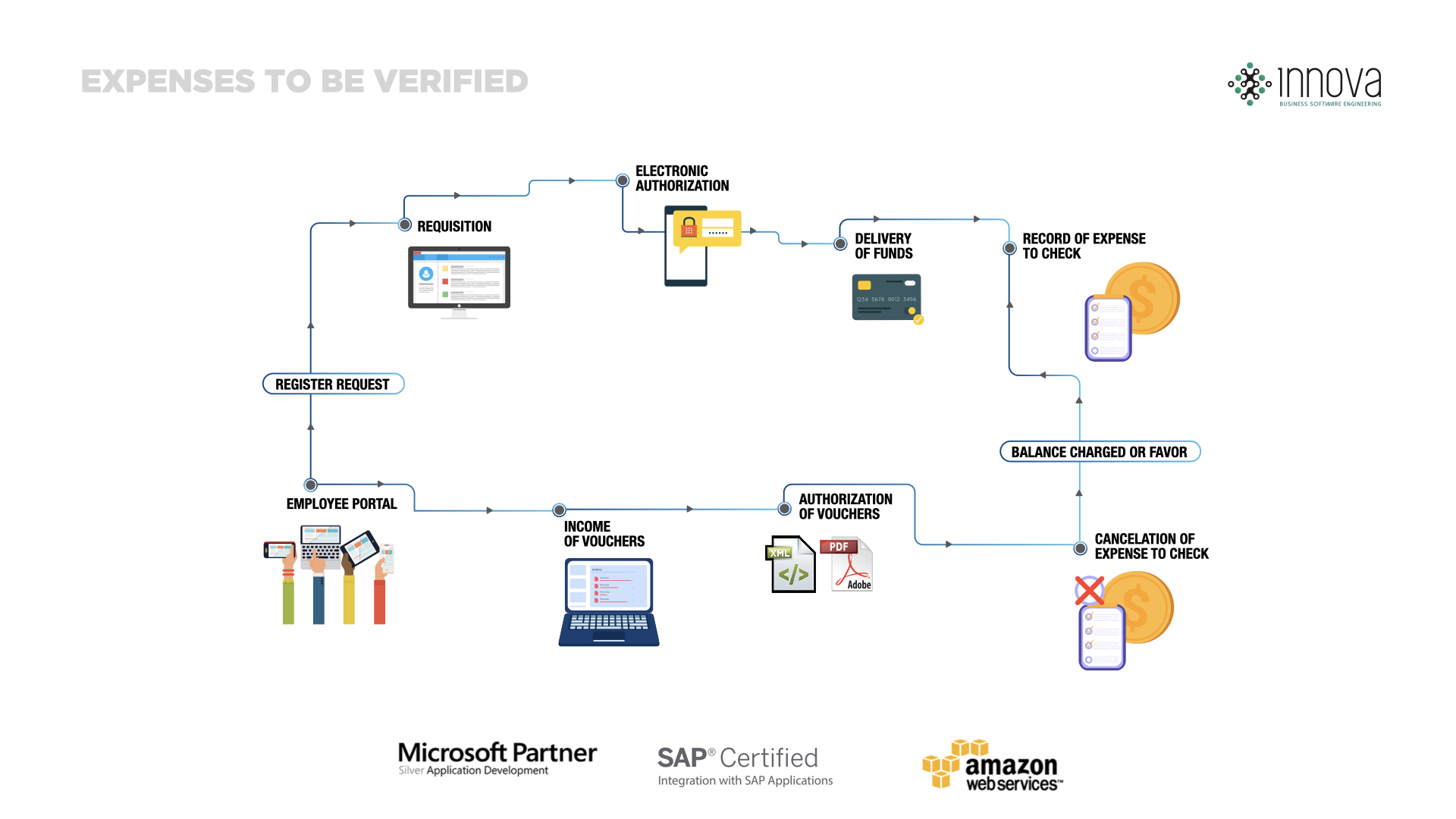

EXPENSES TO BE VERIFIED.

Web portal for electronic control of spending to be verified that includes electronic notifications and authorizations.

- Electronic authorization of requests via web and mobile

- Option to configure types of requests with amount limits for each concept

- Control of balance pending verification

- Reminder of requests pending verification via email

- Automatic register of the expense voucher to verify, and verification of the expense

- Account statement by employee

- Option to download XML and received files

- Validation of CFDI format

- Validation of SAT Black List (69 and 69b)

- Update according to changes in tax provisions

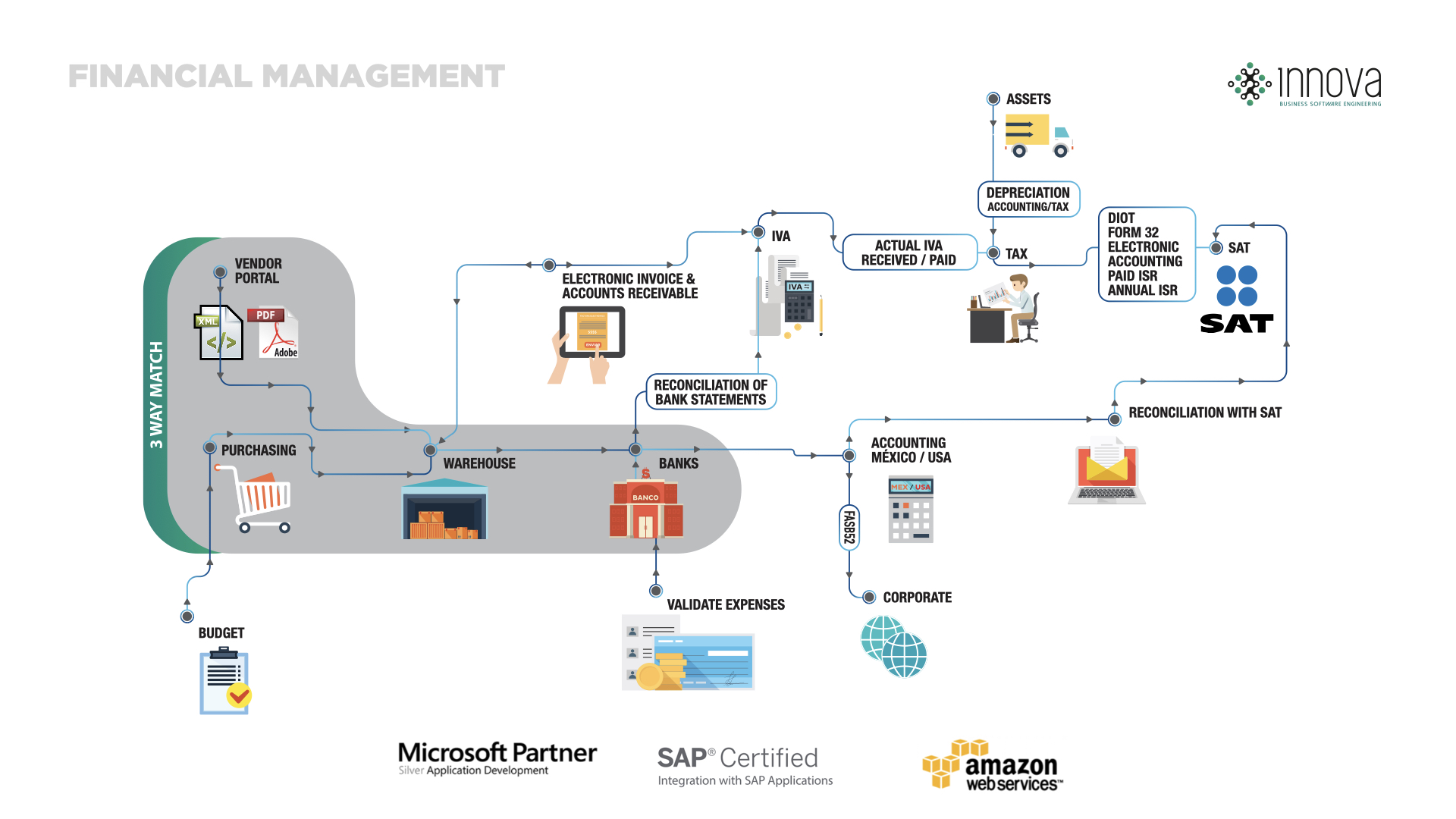

FINANCIAL MANAGEMENT.

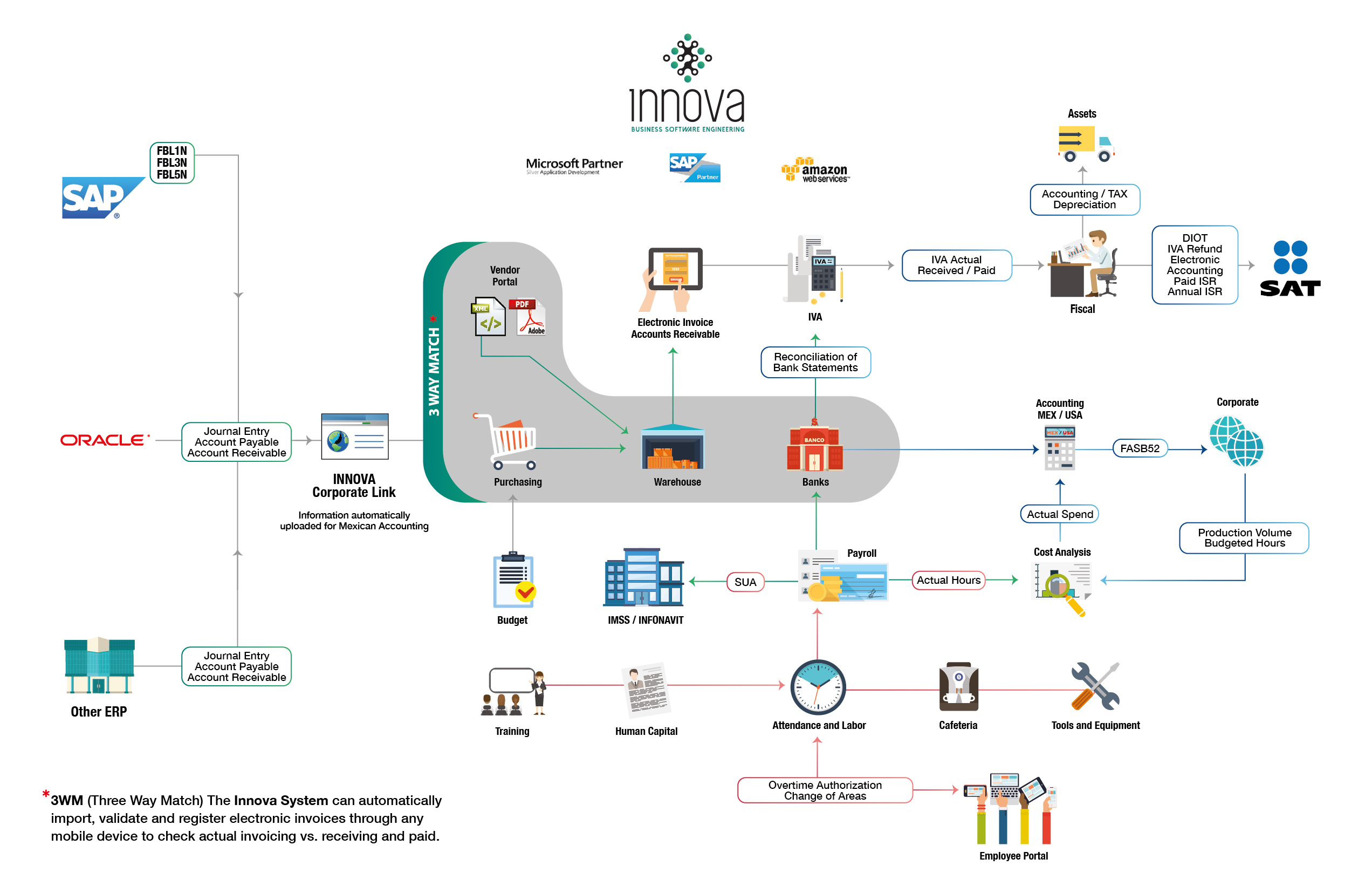

A comprehensive InterModular solution, 100% compatible and complementary with the main corporate systems SAP & Oracle, through their Web and Mobile platforms it automatically controls–fast & easy – all administrative, financial, accounting, tax and economic resource processes; such as FASB-52 for re-evaluation of financial statements.

- Budget control against actual spending and committed spending

- Electronic authorizations of purchase orders

- Verification of receipt of merchandise and services

- Payment of invoices and flow of economic resources

- FASB-52 for re-evaluation of dollar balances

- IVA calculation and DIOT generation

- Electronic accounting

- Blacklist validation

- Handling with payment complements

- Control of expenses to be verified

- Reconciliation of CFDIs with tax mailbox

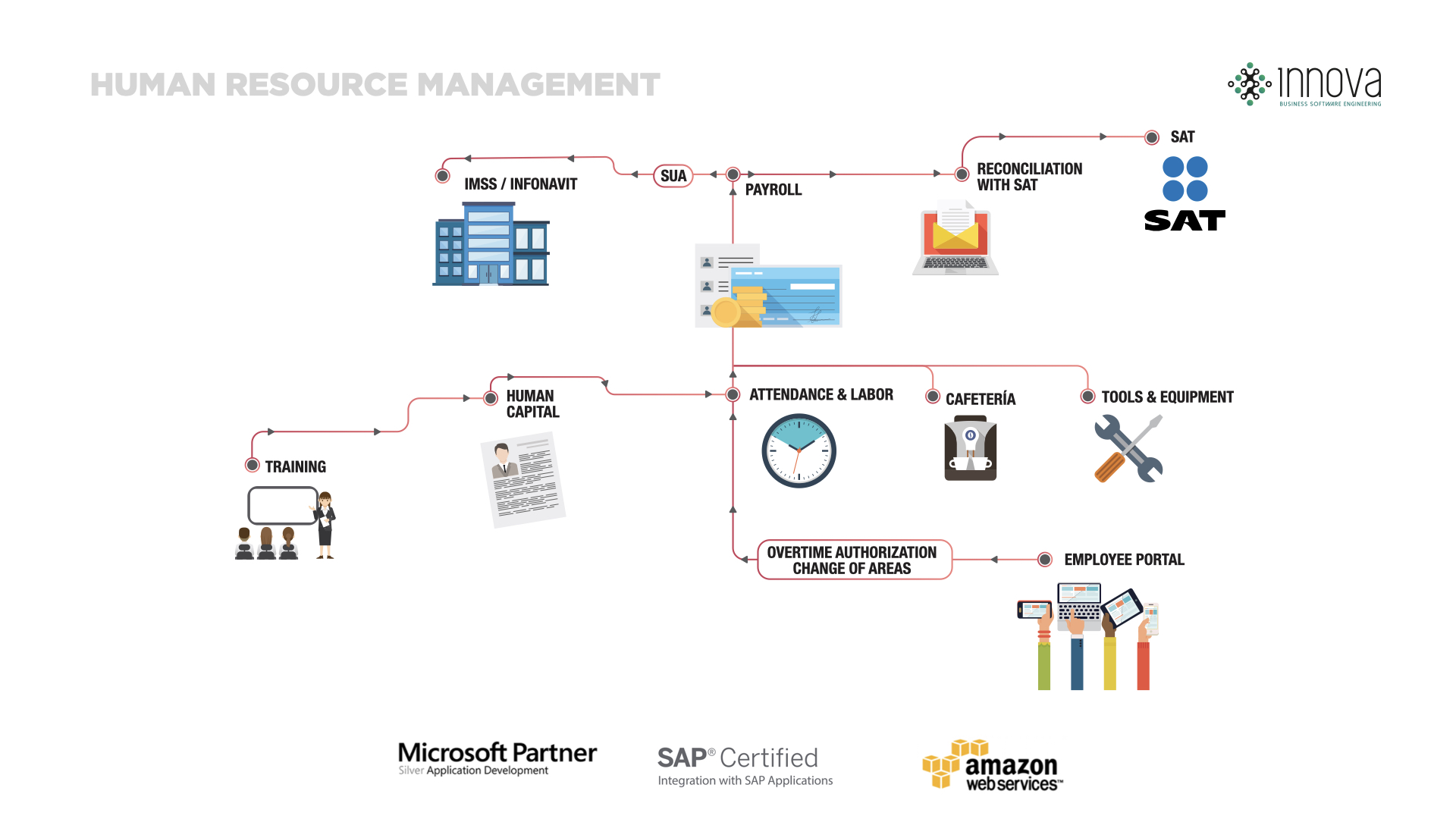

HUMAN RESOURCE MANAGEMENT.

Management of human resources through electronic authorizations according to attendance control, overtime, compensations, loans & benefits; time control through cost center, incidence analysis, notices and quota calculations for IMSS & INFONAVIT.

- Employee digital file, vacation & salary history

- Calculation of settlements

- Automatic time clock control

- Flows for electronic approval of permits, overtime and area changes

- Notices to IMSS and reconciliations with the IMSS software (SUA and IDSE)

- Control of Infonavit and Fonacot loans

- One-click tracking calculation of payroll calculation

- Retroactives

- Control of piecework labor

- Control of training and courses

- Automatic control of cafeteria consumption per employee with accounting application

- Employee portal that allows easy access to the most frequent information required by employees

HERE WE GIVE YOU VALUABLE INFORMATION.

Download the characteristics of the modules.

Information flows, is recorded and has a 100% automatic impact in all administrative, accounting, finance, tax and human resources procedures.