Invoicing and Accounts Receivable

INVOICING AND ACCOUNTS RECEIVABLE.

A solution that is compatible and complementary with Oracle and SAP, aside from other ERP. With this process the user may issue invoices and payment complements, and may control the XML and PDF files issued, Bill of Lading issuance, report of accounts receivable. The option also allows the user to create various invoice folio numbers for purposes of separating invoicing processes of the various plants. Balance seniority reports may be issued with this option, allowing inquire into maturity dates to 30, 60, or 90 days; analysis of expired documents is likewise possible. This option also allows the user to issue account statements by customers, as well as sales reports.

- Invoice generation based on an order or remission.

- Credit and debit note.

- Bill of Lading issuance.

- Automatically affects warehouse stock.

- Generation and submission by electronic mail of the Digital Tax Proof (XML) and invoices in PDF format.

- Enforcement of customs instalment payments and accounting processing of the deposit.

- Monthly report on the digital tax proofs for the SAT.

- Report of balance seniority and accounts receivable.

- Management of price lists and credit limits per customer.

- Predefined discounts by customer over list price.

- Control of inventories by item series and pedimento document.

- Link to the VAT module to generate VAT Refund and Compensation files.

- Importing of the digital tax proof, thus avoiding the entering of the VAT in the INNOVA System.

- Link to the Purchases and Banks module for purposes of automating the entry of the Expenses provision, and scheduling the payment of the invoice.

- Validation of the digital tax proof in SAT.

- Link to the Purchases module against the amount of the merchandise received in warehouse (3 Way Match).

- Print out of the “contra recibo” (Acknowledgment of receipt of invoice).

- The XML and PDF documents are stored in a database with a link to the accounting entry and the VAT data.

- Issuance of Proof of Withholdings, Dividends, Foreign Payments, Withholdings.

HERE WE GIVE YOU VALUABLE INFORMATION.

Download the characteristics of the modules.

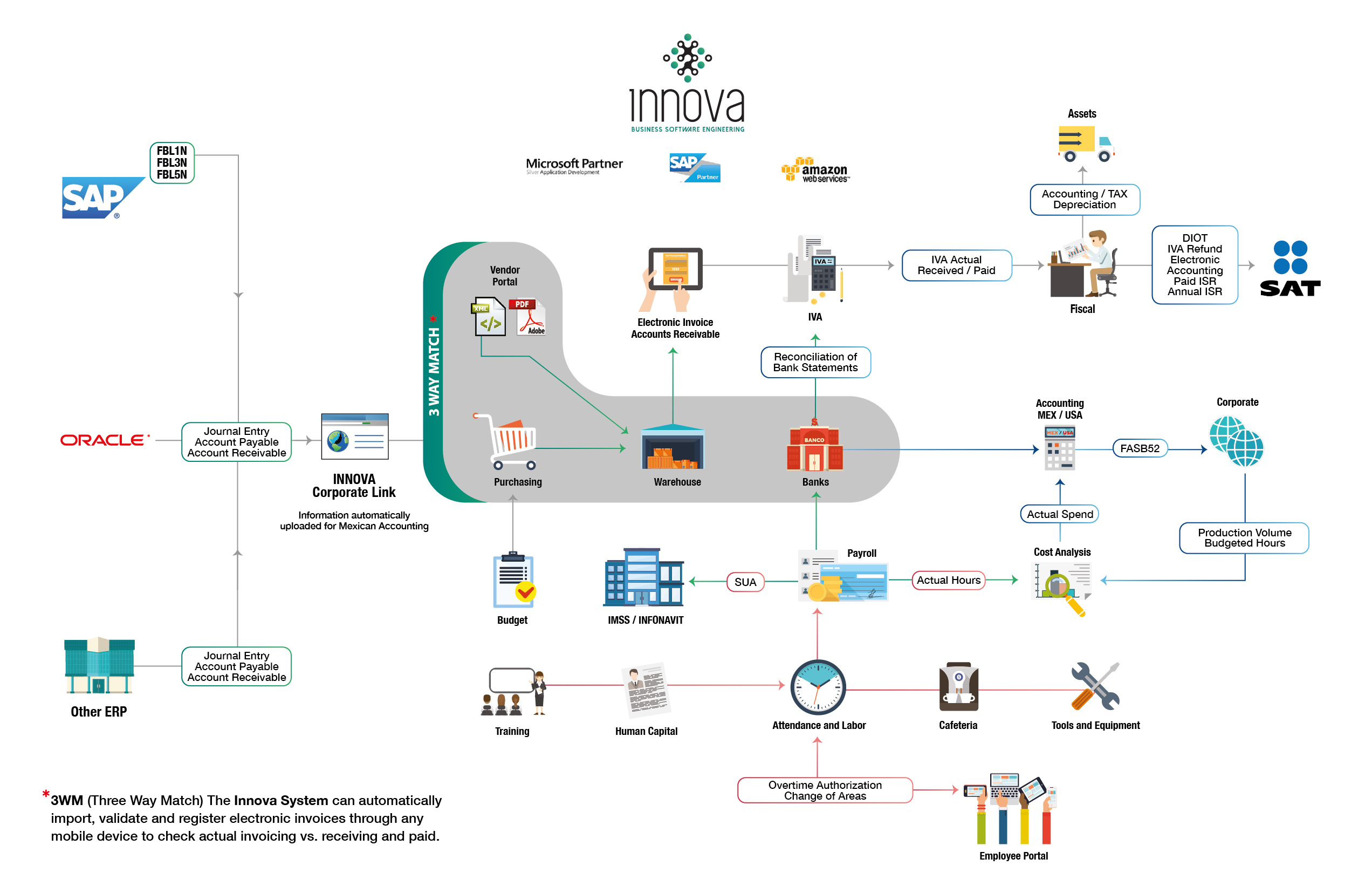

Information flows, is recorded and has a 100% automatic impact in all administrative, accounting, finance, tax and human resources procedures.