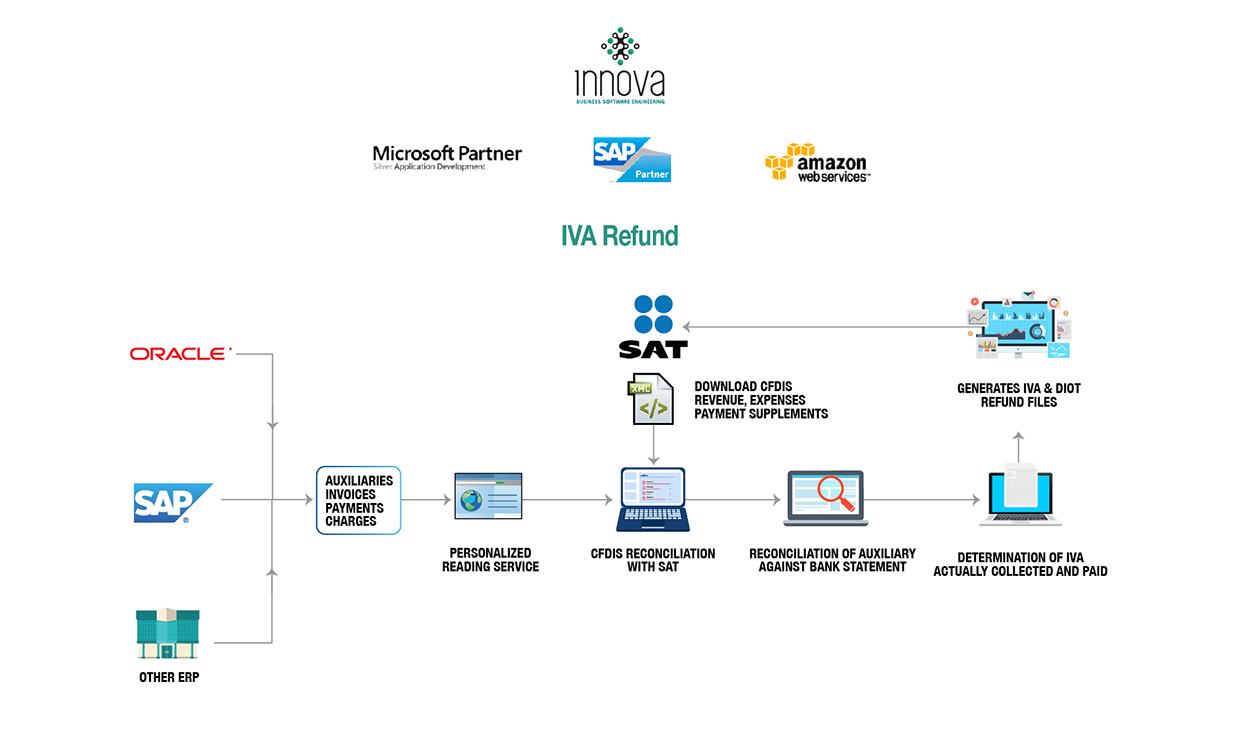

IVA REFUND

IVA REFUND.

Tool for calculate the VAT effectively collected and paid, as well as to generate the VAT refund files.

- Downloading and validation of CFDI concerning income, expenses, and payment complements.

- Validation of the SAT Black List (Arts. 69 and 69b).

- Bank reconciliation.

- Generation of VAT refund files, including Foreign Trade operations.

- Generation of the DIOT (Informative Statement of Operations with Third Persons).

- VAT integration file for customers and suppliers.

- Email notice to the supplier on pending payment complements.

- Allows the user to export into Excel both the information downloaded from the SAT, as well as the reconciliation.

- Downloading of up to 240,000 journals per request.

- Updating in tune with changes in tax provisions.

HERE WE GIVE YOU VALUABLE INFORMATION.

Download the characteristics of the modules.

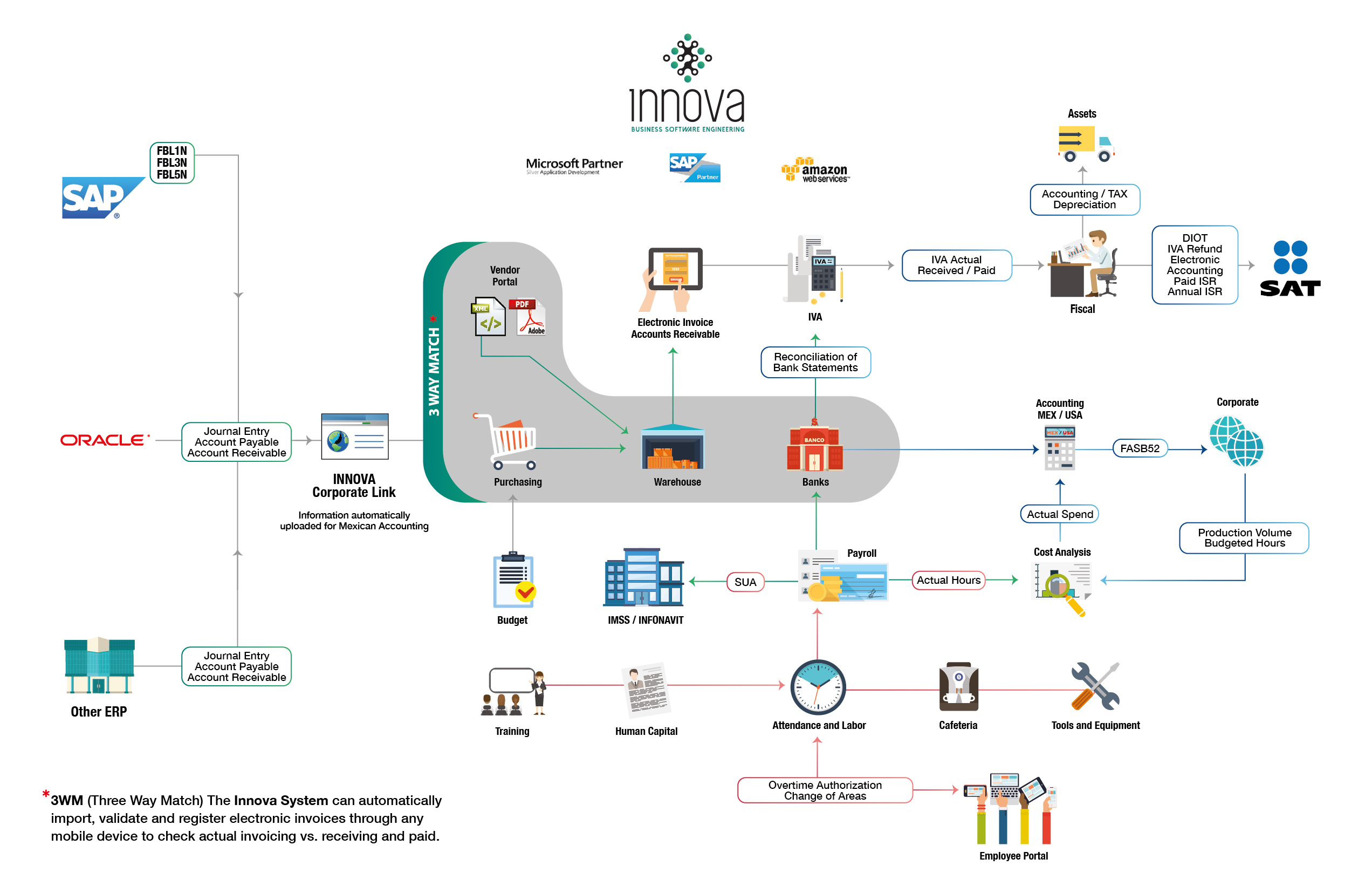

Information flows, is recorded and has a 100% automatic impact in all administrative, accounting, finance, tax and human resources procedures.